Brisk combines the structural benefits of a group captive with the guidance of a risk management consultancy.

Brisk was founded in 2014 by Bob Bernatchez, a specialist in trucking insurance for over forty years. Bob started Brisk to provide members with a better product and stronger voice than competitive programs. Brisk delivers this superiority through size-controlled groups, value-added safety content, proactive financing strategy, and bifurcated claims management.

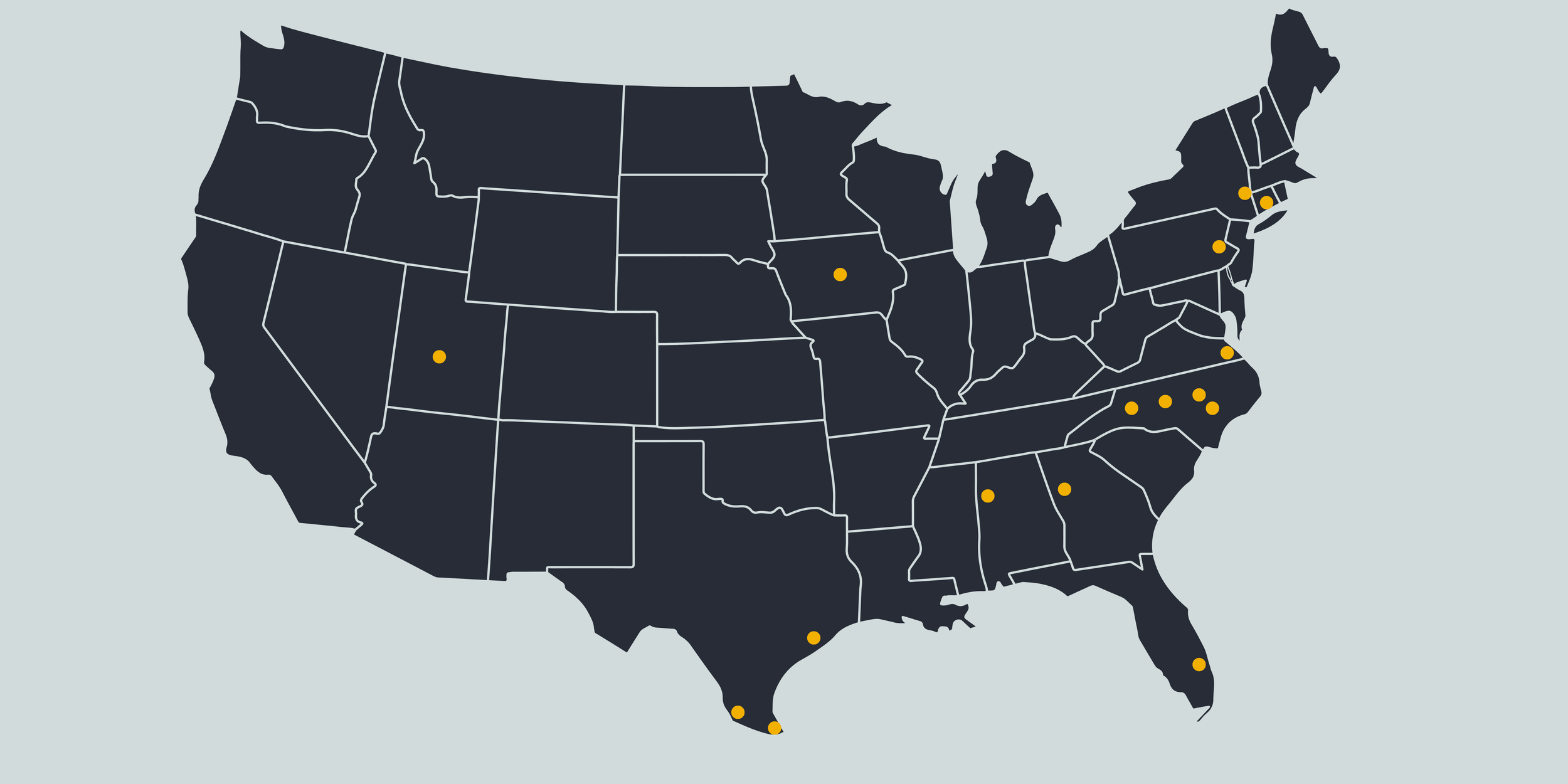

Brisk manages every aspect of liability insurance and worker’s compensation insurance with an eye to risk management, including: program structure, risk strategy, reinsurance partnerships, claims handling, investment management, and onsite safety assessments. Our team consistently analyzes data in order to evolve our program to benefit members. Over a decade of steady growth, Brisk represents 4,000+ trucks headquartered across a dozen states.

Join a league of conscientious trucking companies proven to outperform the market.

We prioritize member success above all, and carefully vet new members to create a situation where the rising tide lifts all ships. Member management teams meet twice per year at resort destinations to review performance metrics, share best practices, vote on important insurance decisions, and socialize with group members. Member safety teams meet once per yer at our exclusive Safety Summit to receive original, high-value content pertaining to trucking safety, claims, and technology.

What is group captive insurance?

Group captive insurance is a form of self insurance that has been used in the transportation industry for over half a century. Members of group programs share common values like accountability, entrepreneurship, and strong safety culture. Group members finance a portion of their risk through dedicated loss funds and secure better reinsurance rates and premiums because they are expected to outperform the traditional insurance market.